Historic Background

Puerto Rico requires to invest in competitive activities of high economic value and positive performance.

> In 2017, the Economic Development Department conducted a study to evaluate the cost and performance of the economic incentives granted. The findings were the following:

- The existence of 58 incentive laws or programs to promote economic activities. (78% of the laws were created before the year 2000.)

- Inexistence of an archive or inventory of the incentives. A Return of Investment (ROI) or performance was not measured.

- A fiscal analysis of all the incentives showed a mix Outlook in terms of the effectivity of each incentive, which demonstrated the necessity to continuously measure the performance related to the investment in incentives (evaluating the impact on the Treasury).

- The fiscal impact of approximately $590M in credits and monetary stimulus, excluding tax exemptions and prime taxes.

- Incentives for export activities or to attract investment to develop the Puerto Rico economy, in a way that is profitable for Puerto Rico’s Government (tourism, manufacture for exportation, exportation services, and international investment).

- The process to grant and comply with the incentives should improve to become more efficient and easier for the beneficiaries.

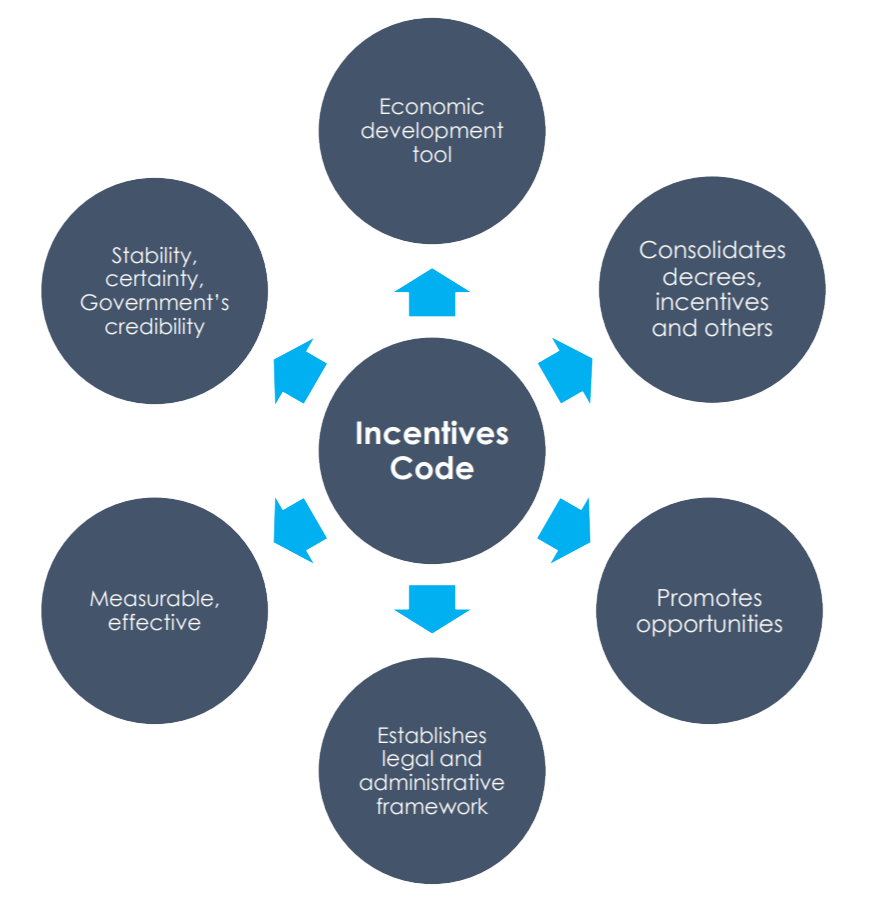

Incentive Codes

On, July 1, 2019

Puerto Rico’s Incentives Code (Act 60-2019) was signed

What is it?

It is an economic development tool with clearer rules and more efficient processes.

- Purpose: Promote the environment, opportunities, and tools needed to create a sustainable economic

development in Puerto Rico.

Objectives

> Consolidate and simplify the processes needed to obtain de incentives.

> Provide more transparency:

- The decree holder’s name will be disclosed and under which of the Code’s chapter the decree is enacted.

- Requires an annual report of the beneficiary’s activity.

- Establishes a rights letter related to the beneficiaries’ information.

Applicability

All the changes established in the new Incentives Code are prospective. Do not affect the enterprises or individuals with decrees, credits, or incentives approved under the preceding Acts.

What makes it different?

1. Adds all the laws and incentives programs under one law.

2. Classifies the incentives according to strategic sectors and economic activities.

3. In agreement with the economic principles proposed to promote innovation, competitiveness, and activities that increase Puerto Rico’s value as an investment destination.

4.Strengthens compliance with the auditing of the incentives.

Significant Changes

- Creates an Incentive Office for Businesses in Puerto Rico in the Department of Economic Development and Commerce. Establishes the position of Incentives Director.

- Creates a digital portal to apply for the incentives.

- Harmonization of the tax rates through industry sectors, to provide tax benefits that applies to all sectors, in general.

- Standardizes the term of the Tax exemption decrees to 15 years, the decree can be renegotiated for 15 additional years.

- Incorporates the Difficult Recruitment Professional Resident incentive.

- Establishes additional benefits for small and medium-sized businesses and incentives for companies that establish in Vieques and Culebra.

- Increases the Resident Individual Investor contribution.

- Grants participation in the private sector in the economic development process, via the Qualified Promoter and Certified Professional.

General Benefits

4%

Income Tax

Rate

4%

Distribution of

Dividends Rate

75%

Property Tax

Exemption

75%

Exemption Over

Construction Taxes

75%

*Municipal Volume of

business tax exemption

Additional benefits for small and medium-sized businesses (income less than $3MM) and exempted businesses in Vieques and Culebra:

- Small and Medium Size Businesses

- 2% income tax rate

- 100% municipal taxes exemptions during the first 5 years

- Vieques and Culebra

- 2% income tax rate

- 100% municipal taxes exemptions during the first 5 years

* The 100% exemption over 3 semesters of Act 73 volume of business tax is maintained.

Sectors - categories

Individuals

Export

Finance &

Insurance

Visitors

Economy

Manufacturing

Infrastructure & Green Energy

Agriculture

Creative Industries

Entrepreneur-ship

Opportunity Zones

Other Incentives

Agile - Simple - Transparent

for

Individuals

DOCTORS

- 4% Fixed Preferential Income Tax Rate

- 15 years Exemption Decree

Extension date to apply:

- Until September 30, 2019, for specialist MD and dentists living in Puerto Rico.

- Until June 30, 2020, for doctors and dentists who return to work in Puerto Rico and to generalist dentists who live on the island.

Note: Senate Project 1620 of June 5, 2020, will extend the submission dates. Pending Governor’s signature. (Source: oslpr.org/sutra)

STUDENTS LOAN REPAYMENT PROGRAM

(Doctors, Dentists, Veterinaries and Scientific Researchers)

- Promotes that the health professionals stay working in Puerto Rico after finishing their studies.

- The Department of Economic Development may grant them an incentive to pay their student loans, up to $65,000. In return, they have to work in the island for at least 7 years.

YOUTH PROGRAMS

Promote an entrepreneur culture

- Incentives to drive the development of entrepreneurship and technological abilities for those from 13 to 29 years of age.

PROGRAMS FOR THE ELDERLY

Promote and develop entrepreneurship potential

- Education and training for those who have reached 60 or more years old, so they can join the workforce or become entrepreneurs.

RESIDENT INVESTOR INDIVIDUAL

- Increases their contribution from $5,000 to $10,000, to non-profit organizations. 50% of the contribution will be made to the investor selected and registered non-profit; and 50% will be made to an entity registered in the Joint Special Commission to assign legislative funds for community impact.

- Commodities, currencies and any digital asset based in block chain are added as passive income, eligible to receive past Act 22 decree benefits.

for

Export

Goods & Services

INCENTIVIZED SERVICES FOR EXPORT

- Artistic Show tickets bought by a tourist, or the transmission and copyright sales of a recording or artistic show to audiences outside of Puerto Rico, musical productions, eSports and Fantasy Leagues events are included.

- Other artistic show incentives are added as monetary incentives.

- Incentives are added to video games.

for

Finances, Investments & Insurance

ELIGIBLE BUSINESSES

- International Financial Entities (Act 273)

- International Insurance Center (Act 399)

- Private Capital Funds

for

Visitor's Economy

ELIGIBLE BUSINESSES

- Hotels, including the operation of casinos, condo hotels, local inns (Paradores), agro inns, guest houses, multi-property rights plans, vacation clubs, Puerto Rican hostelries and Bed and Breakfast.

- Theme parks, golf courses (operated or associated to an exempt hotel business by this Code or any other similar law), touristic shores, facilities in port zones, agro-tourism, nautical tourism and medical tourism.

- Development and administration of sustainable tourism and eco-tourism.

- Development and administration of natural resources that can be used as a source for active or passive entertainment, including caves, natural resources, lakes canyons, forests, etc.

- eSports and Fantasy Leagues activities

for

Manufacture

Includes research & development components

ELIGIBLE BUSINESSES

- Industrial Unit established permanently for the commercial-scale production of manufactured products.

- Fundamental Services to Businesses Conglomerates.

- Main Supplier Services.

- Property dedicated to Industrial Development.

- Animal breeding for experiments.

- Research Enterprises and Industrial or Scientific Development of new products, services, or industrial processes.

- Partial Recycling Activities.

- Total Recycling Activities.

- Sowings like hydroponics, mollusk, crustaceans, fishes, and other organisms.

- Milk pasteurization.

- Agricultural Biotechnology Processes.

- Operations related to the Port of the Americas, former Roosevelt Roads Base Port, and Mayagüez, Yabucoa, San Juan, and Guayama’s Ports.

- Development of programs and licensed or patented applications.

- Video Games Industries.

TAX CREDITS

- Tax credit for buying products manufactured in Puerto Rico

- Up to 25% of the purchases made during the taxable year.

- Research and Development Activities

-

- 50% of qualified investment.

for

Infrastructure

ENERGY PRODUCERS AND SELLERS, BASED IN THE USE OF NATURAL GAS, PROPANE GAS AND HIGHLY EFFICIENT ENERGY

- 5 years are added for producers and sellers of highly efficient energy (natural gas, propane gas and others are added, as defined by the Energy Department).

- It’s clarified that it’s not mandatory to sell the energy to PREPA, in order to receive the benefit.

for

Agriculture

BONA FIDE FARMER

- 90% income tax exemption, instead of 4% fixed rate.

- All the original benefits of wage incentives and bonuses to farmers are maintained.

- The Agriculture Secretary is added as participant of the agriculture incentives concessions.

for

Creative Industry

FILM PROJECTS PRODUCTION

- Tax Credits

- Up to 40% production expenses in Puerto Rico.

- Up to 20% production expenses in Puerto Rico, related to payments to foreign workers.

- Up to 15% is added to production expenses in Puerto Rico (up to a $4 million maximum).

DEDUCTIONS TO FILM INDUSTRY DONORS

- Donations to nonprofit organizations with the authorization to produce feature films, short films documentaries, film festivals, or educational activities aimed at training and develop the film industry, can be deducted in private donors' income tax return, up to 25% of their tax contribution responsibility in Puerto Rico.

- Donations can not exceed $100,000 per filming project.

for

Entrepreneur-ship

PROGRAMS FOR YOUNG ENTREPRENEURS (16 TO 35 YEARS)

- Up to $500,000 tax exemption for 3 years.

- Tax exemption over the personal property and business volume for 3 years.

BUSINESSES ACCELERATORS PROGRAM

for

Others

EXEMPTIONS TO PUBLIC CARRIERS OF AIR AND MARITIME TRANSPORTATION SERVICES

- Cargo transportation overseas.

- Ship rentals for that activity.

- Air transport service.

INCENTIVES FOR CRUISE SHIPS INDUSTRY

- Monetary incentives for cruise ships operators.

Puerto Rico's

Incentives Code

SIMPLE | AGILE | TRANSPARENT